|

Català

| Castellano

| English

| Français

| Deutsch

| Italiano

| Galego

| Esperanto

En aquest lloc «web» trobareu propostes per fer front

a problemes econòmics que esdevenen en tots els estats del món:

manca d'informació sobre el mercat, suborns, corrupció,

misèria, carències pressupostàries, abús de

poder, etc.

|

|

|

Chapter 17. Monetics: a temptation or a challenge.

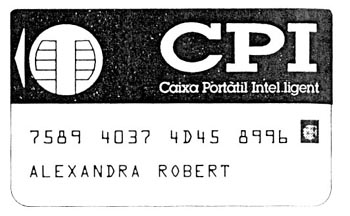

Electronics, as many other human inventions, was born mainly as a military instrument. It has its defenders and its opposents, both radical. Advantages and drawbacks, possibilities and all sorts of dangers are on the table. Its use may reduce the consumption of paper (and therefore of woods) but the screens may damage your health; it reduces transports, consumption of power and of some metals, but depends on an electric and telephone quality network; it frees from many repeating jobs in graphic arts, from secretaries, book-keeping and archives, but it creates 'addiction'; it gives a great autonomy and malleability of use, but also a great concentration of information in the hands of a few... As a matter of fact, the present application of data processing in the field of money (monetics) offers practical advantages (less paperwork, self-control of bank services, greatest security against robbery or fraud...) but then it does not protect people's privacy against possible police and tax control nor against anybody's action with criminal purposes (bribery, manipulation of information...). But let us go step by step. In the first place, what is monetics? it is a computerized currency, when it is interconnected at a distance (tele) it is also called telematic currency (teleinformatics). The cashiers cards for credit or debit payment, are the best known element of monetics. But in order to have a teleinformatic monetary system working it is necessary to have a complex system of card readers, computers and data bases which update the inputs and outputs of the current accounts of all the card users. The best known cards are those with magnetic strip, where among other things the secret code of the user is recorded. The latest cards are those the French call carte à mémoire (card with a memory), and smart card in English. They are also called 'chip card' because the fact that a chip is included is the most distinctive feature, which separates it from the magnetic strip card. The chip, a small, built-in, computer, is the key of its most remarkable features: a better certification (to know if the card is a forgery), a better identification (to identify its owner), a better guarantee (to avoid pirates from deciphering it), a better secrecy (to operate with cipher-messages). The magnetic band cards have become unreliable. Any moderately skilled pirate can decipher the secret code and get hold of somebody else's money. On the contrary, the chip cards are much more reliable and allow besides new functions, among others that of carrying with us our own small bank, practically unassaultable and inviolable. In an automatic cashier of sorts the card user credits it with a given amount of monetary units from his current account. He then carries 'cash' to effect payments in any establishment with the matching reader, without having to look up if his account is overdrawn and without having to carry bank notes, or coins or cheques. The card becomes a purse, a wallet and a cheque-book which may be replenished with 'purchasing power' in the automatic cashiers, without having to carry one cent, while nobody besides the holder can dispose of it. The memory capacity of the chip-card allows to make inviolable the personal identification code and also to record other identification keys, more complex but more reliable and more within reach of everybody, so that the famous code must not be learnt by heart. In this respect there are already available different identification systems related to the physiscal features of the card's owner: finger prints, tone of voice, DNA structure, ballpoint pressure when signing... Generally speaking, chip cards become a means to preserve all that must be protected from forgery and listening-in: access key, confidential transmissions, medical files... They also offer the possibility of becoming a portable file: pocket organizer, personal telephone and address book, basic medical data... Its great capacity to record and classify information allows to reduce the number of cards for every user (cashier, credit, company, medical, parking ... cards) to only one for all these functions.

Only the user has the key to gain access to the confidential information. To peruse joint information between the user and a body, for example a bank, two keys are necessary -as in a safe. A fraudulent attempt of one of the two parties blocks the access and may even imply the selfdestruction of the card. So the chip card offers a great degree of privacy and at the same time leaves track of all the operations. It gives the opportunity to introduce it as a system which, while defending privacy, leaves track for the defence of the lawful State against criminal actions. Let us now see the social possibilities, positive and negative, of monetics. The use of the chip card is much easier and comfortable for the user of any age, young or old. Many old people feel uncomfortable with the problems of having to pay and receive their change with coins and notes, or with the complication of automatic cashiers, which compel to learn secret codes by heart, or with the formalities of having to write and sign cheques. The memory card simplifies all this, and still more if it includes some inalterable, personal identification system, such as fingerprints, hand prints, or voice recording. These are patent systems, feasible and which are alread used in high security areas. Their application allows to introduce the security which some systems need to operate. «The smart card may produce fundamental changes in the economic working of society. For example, used as a key, they may supply the necessary degree of security to grant that the computer networks are really feasible. In order to have a completely electronic system of bank compensations and funds transfers, it is essential to ensure that non-authorized users may not have access to the system. Smart cards may create this actual coupling of data processing and telecommunications1». Electronic invoicing is being added to the electronic transfer of funds from the banks and to the electronic payment with card. «A dozen great European companies of the chemical area are planning to substitute in a few weeks the paper orders and invoices produced by their trade exchanges for a completely electronic system which will indelibly record the corresponding data. [...] This will allow to reduce the costs of the administrative departments and the transcription errors, and to quicken operations. Ecologists defend the electronic exchange2». «In 1986 there were 36 million cards in France. In Europe there were 100 million, and over 800 million circulated in the USA. In the next ten years 80 million new cards will be emitted and 400,000 monetic terminals will be installed in Europe. The value of this industrial market is estimated to be 800 million ecus (in March 1987 one ecu was worth about 7 francs3)» That is, about 110,000 million pesetas. Why is monetics so well accepted? «The cost reduction of the payment system is the main reason. So, the cost of the unit handling of operations carried out by cheque or magnetic card is of about 3 and 6 francs, respectively». «On the contrary, about 1995 the handling costs of payments carried out with memory cards will be as low as 1 franc4!». The use of monetics offers «great advantages to financial middlemen, as it reduces general expenses, mainly because of giving up cheques in about 60%. For shop-keepers, the use of this electronic system will imply the advantage of having an immediate payment system, while present methods -cheque, credit card- imply a delay. Besides, customers will go through the cashdesk much more quickly5». Around 1994 about 80 per cent of cashier's operations in banks will have been substituted by automatic cashiers or by direct payment with card. The mixed card (magnetic band and chip) will be operating in all European cashiers. For the year 2000 a 'universal operative system' is being organized which will allow to carry out operations in any bank in the world. Now, all these possibilities of the intelligent cards are being wasted. Since they were introduced in 1974, over 10 years have gone before the French banks accepted them. As a matter of fact, they are not thriving so much as their promoters had hoped. The following comments are a significant intimation of the problem entailed by the lack of a consistent and democratic application of this technology, which hinders its generalization: «Intelligent cards is still 'a technology waiting for a good application6». «Advanced products find no opening in a market which hesitates to accept the utmost safety.» «For the time being, control through fingerprints has been put aside because of the refusal of the unemployed to be submitted to such a severe control7». The fact is that, while generally speaking, citizens accept that control is inevitable, they do not like to feel totally harnessed. They need to believe that they are not, that they still have some degree of freedom and privacy. «Our privacy is paramount, and our nearest friend or relative knows us only partially. Nevertheless, our private world is foundering. As a matter of fact we are leaving an electronic track full of personal information behind us which, in time, will be able to disclose any feature of our lives, and which, depending on whom has access to it, will notably bear upon our future. This is the path towards which we are inexcusably bound. The future will not exist without the computer science, but precisely because every day our lives are more bound to the computers world, we must take protective steps. The best of all is to have laws protecting us from computer interfering and protecting our privacy. We should all have the right to know which is the information available on ourselves, where it is kept, who has access to it and for which purposes it is used8». In Spain the preliminary draft of a bill prepared in 1984 by the Socialists, which aimed at acknowledging these rights, was stopped by the undersecretaries of the Interior and of Finance. The new draft of Organic Act for the Regulation of the Automatized Handling of Personal Data, does not seem to offer many guaranties of protection of privacy. In France there is a law which follows the guidelines of the European Agreement for the protection of people as far as the automatized handling of personal data is concerned. According to this agreement (in force in Spain since 1985, but not yet shaped in a law) personal information revealing racial origin, political opinions, religious or other convictions, and also personal information concerning health or sexual life, cannot be automatically handled unless the domestic law in every country grants suitable guarantees. Even so, the Agreement, after affirming that 'no exception will be admitted', accepts it when 'this exception, foreseen by the law of a signatory State, is a necessary step in a democratic society: for the protection of the State safety, of public safety, for the monetary interests of the State, or for punishing penal offences; for the protection of the rights and liberties of other persons9». The control system of these ambiguous provisions is entrusted to an independent body. When this is an 'authority' appointed by Government it 'allows coarse breaches of guarantees to take place through lack of a democratic control. The German federal commissioner, according to what is cynically established by the Federal Act for the protection of information, of 1977, 'will be independent and only subject to law. He will be subject to the judicial tutorship of the Federal Government. The federal commissioner will be under the Federal Ministry of the Interior. He will be subject to the hierarchic control of the federal minister of the Interior.' As the German saying goes, 'to hire a wolf to protect lambs10'». In France, on the contrary, the 'National Committee for Data Processing and Freedom, with an autonomous budget and executive structure, informs the Parliament and gives technical support to Magistracy. The 21 members of the Commission are 3 members of Parliament and 3 senators elected by their respective Houses; 4 judges appointed by the Upper Judicial Council; 4 data processing experts appointed by the ministers of Justice, Industry, Science and Education; 3 experts appointed by the trade unions, and four officials appointed by the minister of the Interior11». As a matter of fact in Spain «there is evidence of the automatic handling forbidden by the European Agreement on political opinions and other personal information. Several outrageous decisions in the border control are the visible element which gives away the contents of the personal files of the State Security Bodies and Forces, enough to bear pressure on the Ministry concerned every time there is a project of regulation12».

«The modern State today has a technology available to carry out a control of citizens which we must define as worrying. And the control process is still growing. «The ghost of the 'Überwachungstaat' (the watchful State) is already a fact. Let us take some examples:

«Also in the labour area -offices and factories- the control of white and blue collar workers is growing. In the large German companies it is customary to prepare a personal card for every employee, which supplies information on every step taken during his working hours. «The surge of rationalization, and the introduction of personal computers in the public and private Administrations is almost to an end. The Paisy system, which controls personnel and organizes the human equipment, produces stress and isolation on workers, and damages their physical and mental health. The statistics of the IG-Douck trade union for 1987 show that with the introduction of computerized work places, the level of illnesses and allergies has gone up alarmingly. «The technology of cable television -another popular achievement of the eighties in Germany- after five years experience, has become a new attack against the citizens' brains with its stupid blend of advertising and manipulated news. «To finalize this matter, we must remember the closed-circuit television in every company, underground stations, supermarkets, streets..., which round off the feeling of living already in an 'Orwell' world.» Within this framework, the growth of a movement of rejection of the total surveillance system can be understood, which criticizes not only its instruments but also the so-called 'technology of inhumanity'.

In the face of all these facts, a part of the population may think that anonymity of currency is a rather positive factor, as it is a protection against the big brother (the State). Following this reasoning, the introduction of a monetary instrument such as the telematic cheque-invoice would call for an already 'clean' society, a democratic one, which would not use the new currency as a control tool against the people. To suggest a change of society through a change of currency would amount to start building a house from the roof. The objection is correct. But we must also consider that the problem, up to now, is that all attempts to start building the house by the foundations and walls of the social revolution, have been swamped, without any roof to protect them, neither from factual powers (old or new), nor from the subsequent corruption. Today, in the building area, there are techniques which allow, starting with a few very solid pillars, to start the house from the roof. Simply a few well located pillars, and the roof is a protection for the subsequent building of walls and interiors. No great foundations, nor great main walls are needed. Just a few well-placed pillars, and the roof acts as a protection for the construction of walls and interiors. If a number of rules of the game are not changed, the introduction of the telematic currency without guarantee is an enormous 'Orwellian' danger. But this is the path already taken by the States, the banks, the police, even when they accept laws or agreements: they ignore them, as we have seen, through artful means or through control methods of formally acknowledged rights. We must then find if there is a way to introduce a new monetary system to change the rules of the game which allow up to now to use the control systems only against the people and in favour of the powerful. It is easier to accept a control if you think that it is the same for everybody, citizens and rulers, and if, at the same time, positive results become apparent: social solidarity, improvement in the solution of conflicts, less police repression, lower taxation, more autonomy... In the field of macroeconomics there is another group of unsolved problems, produced by credit cards and by the new means of payment which do not go through the banks -created and offered by financial agents and by large trading companies. The use of cards is making still more difficult the effectiveness and credibility of monetary aggregates (M1, M2, M3, M4...), which are the system of macroeconomic information of Governments, and on whose basis they carry out their economic policy. The new payment means not only bear upon the composition of monetary aggregates, but they also make extremely difficult the calculation of the speed of money. If up to now it was quite difficult to try to know what produces inflation and how it can be relieved, now, with electronic money out of traditional circuits and accounting categories, chaos is enormous. «In fact, the ease for transferring funds from one account to another, makes the relationship between currency stock and gross national product more unpredictable and, therefore, more unforeseeable16». To round off this overview of the two faces of monetics, the key item of the security of the data processing systems must be considered: piracy and fraud. «A group of young Germans [...], the Chaos Computer Club, has been able to decipher all the entry codes to the NASA computer network, in such a way that they have all their data banks available and can even interfere in their operative programmes. This action exposes the weakness of the defence systems of these computers17». «The first case of a computer fraud was the one carried out by Stanley Goldblum, chairman of the board of EFLIC, for a total amount of 27,000 million pesetas, which he obtained by issuing a great quantity of false policies. [...] The banking area of the USA estimates a yearly loss of over 280 million dollars through frauds carried out by its own personnel (10 times more than the losses due to holdups. [...] In the United Kingdom, one single employee of the data-processing area of an American bank obtained 1,600 million pesetas in just one day. [...] The great risk is terrorism. It is very simple to paralyse basic necessities activities by acting on the key points of a data-processing system; for example, traffic18». To avoid this sort of problems there are very reliable systems (see next chapter) which are not ordinarily used on the argument that they are more expensive than the losses originated at present by piracy. The question is whether it is not possible, or there is no will to do it. The problem of these security systems is that they do not allow the fraudulent access of anybody, not even of those in control of the body where they are adopted. Perhaps, what is feared by the managers who do not consider profitable to spend money in security... is to lose the possibility of handling information on their behalf in order to conceal their irresponsibilities. As far as the use of monetics in the western-industrial context is concerned, after having considered the main possibilities and their great dangers, we have three options which can be taken: First. A rejection of the use of electronic money. To take the decision to stop the proliferation, and to effect the suppression of electronic money, we must accept the re-proliferation of traditional payment systems (paper money). This would leave for solution, in present complex societies, all the faults which have been found up to now with this sort of anonymous currency. Besides this, criticizing and rejecting the computer science -in this case, monetics- implies the risk of actually perpetuating it, if the way is not found to ensure its completely effective, practical and daily disappearance, a way which may not be easy for lack of popular support or because of the scientific-technical dynamics itself created in the West. Second. Guarantee of a democratic use of electronic money. Up to now, the introduction of monetics has not been submitted to any social debate nor to any global legal nor political framework, which would allow a consistent and democratic use of it. It has been the result of having technological research meet trading interests of companies producing monetic services and the interest in cost reduction, or to improve the banks' and other companies' services. Some shy legislations set forth, but do not solve, a very difficult problem: how to reconcile within a lawful State, the necessary transparency of the citizens' actions with the protection of their privacy, which is the basis of protection against the abuse of the powerful. By whom and how are controllers controlled? In the field of macroeconomics, the possible contributions of a consistent application of monetics is a matter completely unknown to most economists, who apparently have never even asked themselves about it, while its partial and rapid introduction is producing modifications of the financial system which they do not know how they can be discovered and controlled. In the legal framework the introduction of monetics sets forth serious problems because new types of informatic crimes must be faced, but in no case the judicial bodies appear to have stopped to consider the vast possibilities offered by an exact and exhausting documentation system to research crimes and offences and to obtain conclusive evidence, whose default today prevents in many cases to condemn not only financial scandals, but also a great number of the cases which are judged and which, directly or indirectly, are related with money. The inefficiency of justice therefore justifies the actions of a very dangerous repressive police. All the above makes the study and submission of guarantees for the use of electronic currency a venue for finding solutions to some of the most serious problems that its disorderly introduction is causing, and at the same time to open the doors to deal with other problems which up to now had been rather insoluble. These guarantees -which we shall develop in the following chapters- include a parcel of:

The third option lies in considering that the reality of monetics is not important. For one reason or other, more or less interested or interesting, the idea is to leave things as they are in this matter. To take this position -without becoming accomplice in the present situation- we must have the ability to act in other more important areas, which would indirectly imply a substantial modification of these 'secondary' monetary realities. Notes: 1Robert

McIvor, «Tarjetas inteligentes», Investigación y Ciencia,

enero 1986.

|

It

may be a good thing to analyse a social model of application of the computer

science which is leading us to the dreadful world described by George Orwell

in his novel Nineteen eighty-four. This actual model has been introduced

in the Federal Republic of Germany, which, in spite of having signed the

European Agreement on the protection of information, becomes the leader

in its infringement and a model for other countries in the EEC. Let us

see the description made by a German citizen

It

may be a good thing to analyse a social model of application of the computer

science which is leading us to the dreadful world described by George Orwell

in his novel Nineteen eighty-four. This actual model has been introduced

in the Federal Republic of Germany, which, in spite of having signed the

European Agreement on the protection of information, becomes the leader

in its infringement and a model for other countries in the EEC. Let us

see the description made by a German citizen The

export of the German model is a fact. «When in 1977, Rodolfo Martín

Villa visited the BKA in the FRG, he received a lesson of postmodern machiavellism;

[...] he was shown that the most aggressive centralism was compatible with

a federal State. He learned how, thanks to powerful data-processing systems,

personal bank data were connected to those of the Social Security, University,

Justice and Finance Administrations. The programme was bought by the Ministry

of the Interior as a model for the State of self-governed regions, and

it has been an heirloom which the Socialists have taken up. While all over

Europe the social regionalistic, autonomistic and nationalistic movements

are increasing, which claim for a decentralization and self-government

or independence, the new technologies allow the States to introduce systems

of centralism much stronger than what had been born in the past. Strategic

data-processing may empty of their contents political notions such as federalism,

autonomy or independence, depending on who is controlling the central computers

The

export of the German model is a fact. «When in 1977, Rodolfo Martín

Villa visited the BKA in the FRG, he received a lesson of postmodern machiavellism;

[...] he was shown that the most aggressive centralism was compatible with

a federal State. He learned how, thanks to powerful data-processing systems,

personal bank data were connected to those of the Social Security, University,

Justice and Finance Administrations. The programme was bought by the Ministry

of the Interior as a model for the State of self-governed regions, and

it has been an heirloom which the Socialists have taken up. While all over

Europe the social regionalistic, autonomistic and nationalistic movements

are increasing, which claim for a decentralization and self-government

or independence, the new technologies allow the States to introduce systems

of centralism much stronger than what had been born in the past. Strategic

data-processing may empty of their contents political notions such as federalism,

autonomy or independence, depending on who is controlling the central computers