|

Català

| Castellano

| English

| Français

| Deutsch

| Italiano

| Galego

| Esperanto

En aquest lloc «web» trobareu propostes per fer front

a problemes econòmics que esdevenen en tots els estats del món:

manca d'informació sobre el mercat, suborns, corrupció,

misèria, carències pressupostàries, abús de

poder, etc.

|

|

|

Chapter 6. The unstoppable abstraction.

Drafts, banknotes convertible into metal, and today's totally inconvertible paper money, have been practical essays to get free from the gold bond. Hand or electronic notations in current accounts have finally laid down the total abstraction of currency as a debt acknowledgement and a unit of account. The inertia which hinders the change of institutions is caused by many factors. Some are technical -a given instrumental inability to carry out a new proposal-; some belong to the human dynamics, where all changes are always difficult. But there are also «inertias» held more or less knowingly and defended by the social groups which take profit from them. It certainly would be odd to see Aristotle formulating his theory while Alexander the Great is spreading Greek imperialism and, therefore, allowing metallism to be put into practice with all its possibilities: purchase of treason, monetary transformation of plentiful plundering and of «metallic» tributes, extension-penetration of trade in foreign countries... Evidently metal currency is a good weapon of, cultural and commercial penetration, because it easily breaks any economic and traditional exchange structure in the invaded populations, thanks to the easy use and to the enchanting magic of precious metals.

Paper-money is based on the social convention which has made it the necessary instrument for the acts of trading, and for the trust put in it as an instrument suitably carrying out its function. It is an auxiliary and abstract value. The monetary system has recovered Plato's nominalist theory. And the subsequent facts -cheques and cards- have further increased its abstraction. When a change takes place in the monetary system, it is necessary to protect the social practice with a number of myths and signs which perpetuate the trust of the old system in the new one. It is very odd that still three years ago the Banco de España (Spanish national bank) would «pay to the bearer the amount of pesetas in notes», in gold, even though this had been impossible to carry out for many years. We can also see a similar case in the convex shape of the Sumerian tablets, which are a trace of the previous spherical system (see chapter 10: «A trip through Eden»). It is also odd to see that after 18 years from the death of Franco, the coins proclaiming him «leader of Spain by the grace of God» are still in use. The difficulties to control the monetary inflation and to get free from the dangers of recession; the very serious problems derived from the hegemony of the dollar in international trade and, especially, the unpayable foreign debt; the dictatorship of the International Monetary Fund and of the World Bank, carried out on behalf of the strong countries controlling them; the divorce between financial speculation and actual economy; the destructive oblivion of the ecological system by the economic system... are the most important facts for the life of people and of the planet. These facts appear to be serious enough to try to find, through a new monetary system, a more accurate instrument that would deal with them more effectively. Peter Drucker, a famous North American economist, hardly suspicious of subversive positions, has clear ideas about it: «We need a new simplifying synthesis of reality to enfold the present economic reality. If this doesn't happen, we may find ourselves at the end of the economic theory; that means that there will be no bases for the action of the Government which runs the cycle of business and of economic conditions1». «Transnational economy is shaped and controlled by the financial flows which have their own dynamics». «'Real' economy of goods and services does no longer control transnational economy. This, on the contrary, is done by the symbolic economy of money and credit. Every day, the inter-bank market in London runs 10 to 15 times the amount of transnational currencies [...] beyond what is necessary to finance the world exchanges of goods and services». «90 per cent or more of the financial transactions of transnational economy have no use for what economists consider an economic function. They are only used for financial functions». «It is the symbolic economy which widely controls the real economy2». When in May 1990 Professor Drucker was appointed doctor honoris causa by the Universitat Politècnica de Catalunya, he surprised everybody with the beginning of his lecture «We are all aware that we live in an age in which technology changes very rapidly. Many think that this happens in «high technology». At present, technological changes take place more in fields which have been considered as «low technology» or «non technology» than in high technology fields. The largest technological changes of the last years have not taken place in the field of computers, nor in that of biotechnology, but in the field of bank and finance. As a matter of fact, the banking business is rapidly going from being something related to money to be something related to information3». Notes: 1Peter

F. Drucker, «La nuevas realidades» Edhasa, Barcelona, 1989,

pp. 230-231.

|

Only

after 1914, when the war had to be finished in three months due to the

exhaustion of the gold reserves, was the decision taken to seize the opportunity

to introduce paper-money instead of gold. A new path was therefore opened

for the penetration and subtle exploitation through the use of the official

paper-money, as a legal support of the over-utilization of bank money.

World War II was used to end the use of gold on an international level.

The Bretton Woods agreements, signed in 1944, accepted that the US dollar

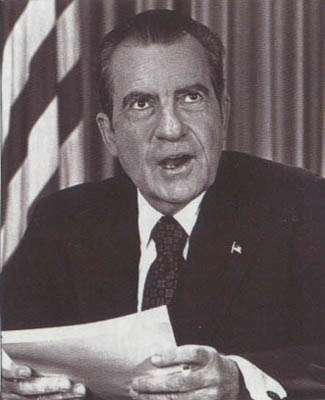

would be convertible into gold. But in 1971 president Nixon gave a unilateral

notice of their termination. Since then, paper-money has nothing to do

with gold nor with any merchandise, it does not represent any amount of

gold and it cannot be converted into it, neither inside each State nor

in the international relationships.

Only

after 1914, when the war had to be finished in three months due to the

exhaustion of the gold reserves, was the decision taken to seize the opportunity

to introduce paper-money instead of gold. A new path was therefore opened

for the penetration and subtle exploitation through the use of the official

paper-money, as a legal support of the over-utilization of bank money.

World War II was used to end the use of gold on an international level.

The Bretton Woods agreements, signed in 1944, accepted that the US dollar

would be convertible into gold. But in 1971 president Nixon gave a unilateral

notice of their termination. Since then, paper-money has nothing to do

with gold nor with any merchandise, it does not represent any amount of

gold and it cannot be converted into it, neither inside each State nor

in the international relationships.